Should I switch to cash?

How to time Investment Markets?

At Howard Wright, we are strong believers in remaining invested through market volatility. Yes, there will be times when changes need to be made to the portfolio, but one of these changes should not be to sell everything to cash when markets fall with a view to reinvesting when things calm down or start to pick up. There are a number of reasons for this some of which we will review now.

The first reason for this, is to do with how the investments we hold in your contracts are traded. The investments used within our portfolios are called Open Ended Investment Contracts or Unit Trusts. If you decided right now to sell these, you don’t actually sell these funds from your investment contract until the next pricing point. For example, if the pricing point is 1pm and you decide at 2pm that you want to sell, you will still hold this fund until 1pm the next business day.

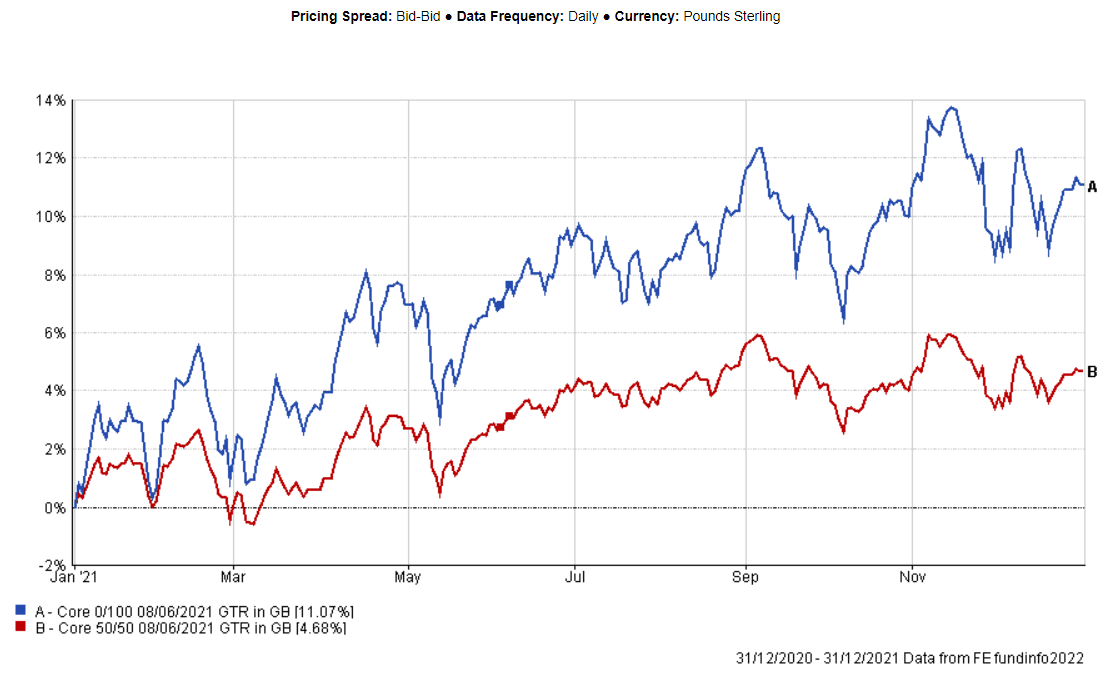

Another reason for remaining invested through volatility, is to do with how you time not only the decision to sell to cash, but more importantly, the decision to go back into the market. When markets are performing well, it is very unlikely that at this point you would want to switch to cash. The following graph shows our Core 50/50 and 0/100 portfolios, there have been a number of points over the last 10 years where you may have looked at your funds growing above the target and thought they had peaked only to see them continue to grow.

If you had switched to cash every time it had grown above target, only to see the funds continue to grow, you become faced with the even harder decision of when to reinvest from the cash position.

The main problem you would have faced over these last 10 years with doing this, is that you sold out as the portfolio was ahead of target, but the overall trend has still been positive. Not only would you now have missed out on growth, you would be trying to reinvest back into the portfolios when the values are even higher than what you previously thought was the peak. If and when the funds do see falls, you are in danger of not only having missed out on the growth whilst in cash but then suffer the falls from the new peak after reinvesting your capital.

It is equally as difficult to time markets the other way too. As you are unlikely to want to sell the investments when they are doing well as discussed above, it is also rarely the right decision to sell when markets are falling. As you know, and can see from the graph above and below, when investing in equities and bonds the performance line is not a straight one. In fact it is almost a constant up and down, historically with a longer term positive trend. I have zoomed in on the calendar year 2021 in the chart below to illustrate the next point.

If you were to try and sell out of the investments every time you have a down day you will be forever going in and out of the portfolios. As detailed right at the top of this article, due to pricing points, you could find that you make the decision to sell your investments into cash at the end of a down day, which then doesn’t trade until the following day. However by the time the sale is made the outlook may have changed.

Like in the first example, if you do sell after a fall, a decision then needs to be made as to when you re-enter the investment funds. Do you decide to re-purchase the funds after a few days of growth, a week or a month? You could be in danger with this approach of selling after a fall and taking the loss, missing out on the recovery as you are now in cash, only to re-enter the funds just as they start to fall again. If you repeat this process a number of times, you may be in the markets for the majority of the falls and out of the markets for the majority of the growth.

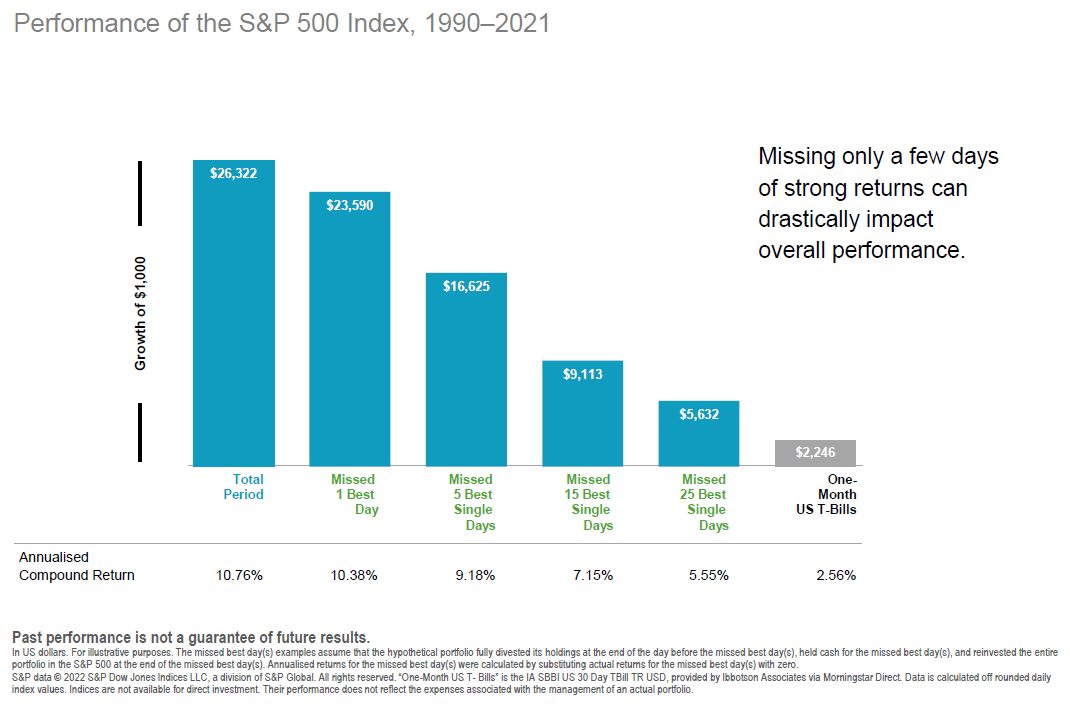

There is some interesting data which focuses on the USA, specifically the S&P500 index, that I would like to share with you, which further strengthens the argument for remaining invested. The chart below illustrates that over the last 31 years, if you had invested £1,000 into the S&P500 and left it through all the ups and downs, it would have grown into £26,322. If you had attempted to time markets and missed the single best day in the entire 31 year period, this value is now only £23,590. If you missed out the 5 best days over the entire 31 year period then the growth achieved falls dramatically to a total value of £16,625.

We do understand at Howard Wright that no one likes to see their investments fall but hopefully as you have seen from the article above, that sitting tight remaining invested and waiting for investments to recover is the right thing to do the majority of the time. It is important therefore to use a risk you are comfortable with so that any falls are within your tolerance and you do not panic and switch to cash. At Howard Wright we are experts in helping our clients not only target future objectives, but doing so with a risk strategy that is right for them.

Free Financial Review

If you would like to review the risk of your existing contracts or look to set up new contracts and would like to ensure you are utilising the correct risk for your objectives and tolerances contact Ashley Smith one of our Chartered Financial Planners at Howard Wright, you can call him on 0345 688 4939 or you can fill in our enquiry form below, it only takes 20 seconds to complete. We look forward to hearing from you and seeing how Ashley can help.

Disclaimer

This article contains information from sources believed to be reliable but no guarantee, warranty, or representation, express or implied, is given as to its accuracy or completeness. Howard Wright Ltd does not undertake any obligation to update or revise any future statements. Past performance is not a reliable indicator of future results. Investments can go down as well as up and actual results could differ materially from those anticipated. This article is for information purposes only and has no regard to the specific investment objectives, financial situation or particular needs of any person as such, the information contained in this article is not intended to constitute, and should not be construed as, investment or financial advice. Appropriate personalised advice should be taken before entering into any transactions. No responsibility can be accepted for any loss arising from action taken or refrained from based on this publication. Howard Wright Ltd is authorised and regulated by the Financial Conduct Authority.